Establishing a start-up business requires a creative and complete idea of how your venture will run. A good product is not enough to ensure the success of your enterprise. During your planning stage, you need to think and be sure about the legal structure of your business. There are two primary business structures popular among small enterprises in Singapore: sole proprietorship and private limited company.

Your decision influences other aspects of your business, such as tax payment, liability, and more. If you are a new business owner or still in the planning stage, choosing between the two may be confusing. To help you, let us compare the difference between sole proprietorship ventures and private limited companies.

WHAT IS A SOLE PROPRIETORSHIP?

A sole proprietorship is a business established by one individual. It is considered the most straightforward way of starting a business for Singapore locals. Only Singapore citizens, permanent residents or EntrePass holders, who are at least 18 years old, can apply for this type of business.

For foreigners who do not reside in Singapore, they can still establish this type of business, as long as they appoint an authorised representative who is living in the country. The said authorised representative has the full legal capacity to ensure the company complies with regulatory requirements.

While it is easier to manage, a sole proprietorship doesn’t provide a separate legal entity from yourself. It means that your personal assets are not protected from the business risks of your company. This set up makes you accountable for all liabilities that your venture experiences. In the instance you are unable to pay a debt, creditors can go both the company’s and your assets.

WHAT IS A PRIVATE LIMITED COMPANY?

A Private Limited Company (Pte, Ltd, or LLC) is an exempt private company limited by shares. Here, you can establish a venture with 1 to 20 individual shareholders and as many directors as you need. Shareholders of a private limited company can consist of individuals, corporate entities, or both. It is considered as the most scalable, advanced, and flexible business structure in Singapore. For these reasons, many local businesses choose to go with the said structure rather than a sole proprietorship.

By creating a private limited company, you’re divorcing your business as a separate legal entity from yourself. As a result, this structure limits your liability as an individual. When your company acquires debt or losses, it will not impact any of your assets. Furthermore, the risks and responsibilities are made in the company’s name instead of yours.

A private limited company can be 100% locally owned or foreigners, as there are no foreign shareholding restrictions. Here, you need to appoint at least one resident director, who should be at least 18 years old. They can be a Singapore citizen, a Singaporean permanent resident, or an EntrePass holder (with a residential address in Singapore).

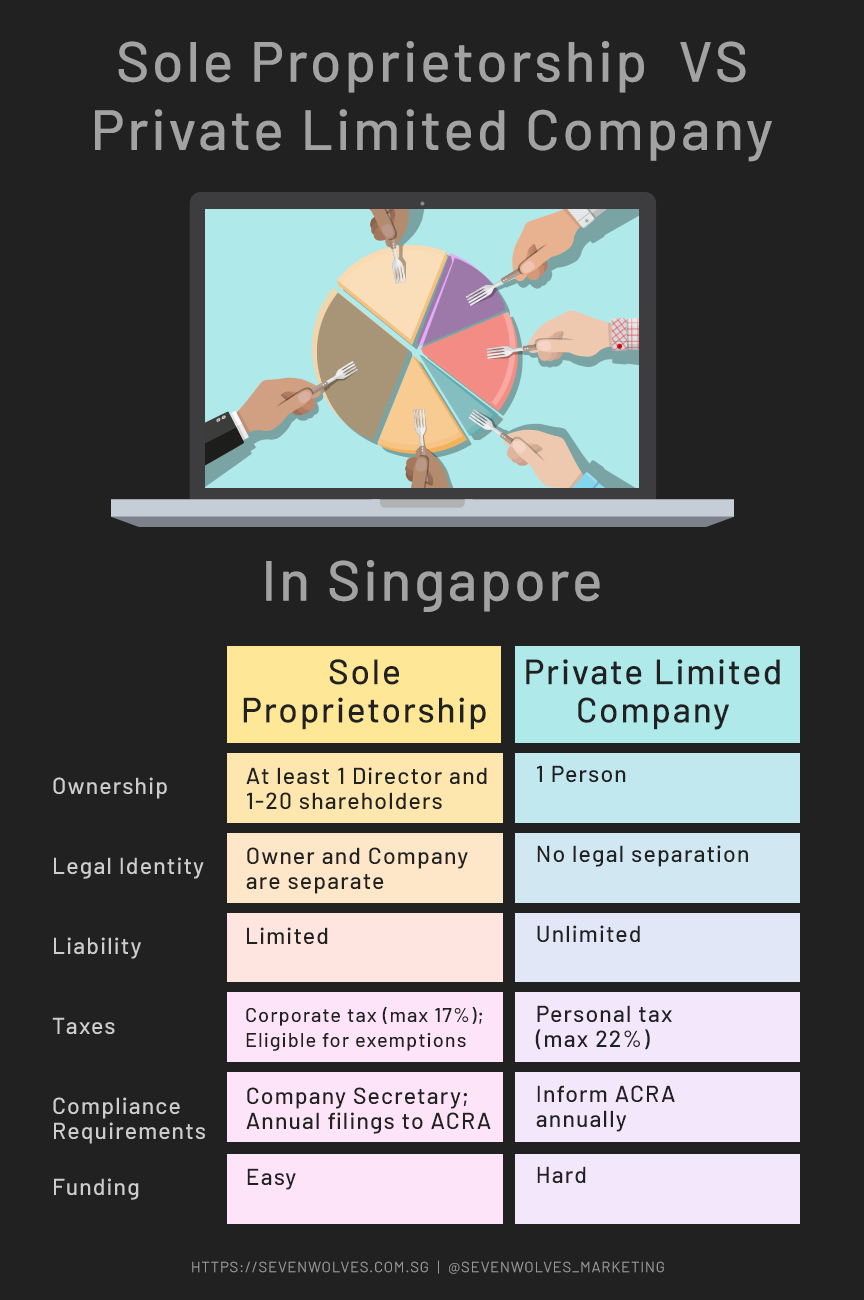

DIFFERENCE BETWEEN SOLE PROPRIETORSHIP AND PRIVATE LIMITED COMPANY

Here are the differences between a sole proprietorship and private limited company in various aspects of a business:

Legal Identity & Liability

As mentioned earlier, sole proprietorship has no legal identity separating the company and its owner. As a result, the sole proprietor is personally liable for debts and losses of their business.

On the other hand, a private limited company separates the business as a legal entity from its shareholders and directors. Here, shareholders are not personally liable for company debts. Their liability is limited to their investment in the company.

Ownership and Autonomy

A sole proprietorship is owned by a single person, giving them greater autonomy in their business.

On the other hand, in a private limited company, directors owe fiduciary duties to the company and its shareholders. With that said, the latter can scale and expand the business more easily.

Statutory Requirements

A sole proprietorship has minimal filing requirements, as the income tax is assessed based on the owner’s personal tax return.

A private limited company has more compliance requirements to meet, including:

- Appointing a Company Secretary

- Holding Annual General Meetings (AGMs)

- Filing it Annual Returns (AR) with the Accounting and Corporate Regulatory Authority (ACRA)

If your business does not fall under the “small company” criteria, then you need to appoint an auditor. Furthermore, income tax for private limited companies is assessed in their corporate tax returns.

Income Tax

Profits of private limited companies are taxed at a corporate tax rate of 17%. Qualifying start-up Private limited companies are granted the Tax Exemption Scheme during the first 3 Years of Assessment. For YA 2020 onwards, the government can exempt $125,000 out of the first $200,000 of chargeable income. Furthermore, from the 4th Year of Assessment onwards, private limited companies can get Partial Tax Exemption. Here, $102,500 out of the first $200,000 chargeable income is exempted.

For sole proprietorship, profits are taxed by individual tax rates. If you’re a Singapore tax resident, progressive tax rates of 0% up to 22% is applied, from Year of Assessment 2017 onwards. While a qualifying start-up Private limited company enjoys significant tax exemption, sole proprietors pay higher taxes during the same period. The tax exemption schemes mentioned do not extend to a sole proprietorship.

Financial Support

There are more financial support grants available to private limited companies compared to a sole proprietorship. Some of the grants available for the former includes:

- Start-up SG Equity

- Start-up SG Founder

- Market Readiness Assistance (MRA)

Businesses applying for the Start-up SG Equity grant need to be incorporated as a private limited company. On the other hand, applications by sole proprietors for the MRA grant are assessed on a case-by-case basis.

Furthermore, obtaining loans and external investments is harder for sole proprietorship as the business is tied to your assets. A private limited company can raise its capital easier through bank loans, issuing equity, and external investments.

Corporate Income Tax (CIT) Rebate & SME Cash Grant

A private limited company is eligible for CIT Rebate and SME Cash Grant. For YA 2018, CIT Rebate is 40%, capped at $15,000; while for YA 2019, CIT Rebate is 20%, capped at $10,000.CIT Rebate is reflected on the venture’s income tax computation and assessment.

Sole proprietors are not eligible for CIT Rebate and SME Cash Grant. With that said, they may acquire a personal income tax rebate when granted by the government.

Regardless of which business structure you choose, your success will also rely on how you market your product or service. In this digital age, the market is far more competitive, especially when it comes to garnering customers online.

However, not all start-up owners have the time and resources to have an in-house marketing team of their own. For sole proprietors, it’s additional workload and expenses. At the same time, it is hard to build a team that will appease everyone in a private limited company.

With that said, no need to worry. There are many marketing firms out there who give their expert knowledge, without having you spend a lot of money.

SEVEN WOLVES DIGITAL MARKETING FOR SOLE PROPRIETORSHIP AND PRIVATE LIMITED COMPANY

Managing your business’ digital marketing strategies on your own is tough. Instead of managing them yourself, as mentioned earlier, you can hire a team of experts in this particular field, to do it for you. Seven Wolves has a team of digital marketing gurus that specializes in various aspects of digital marketing. The digital landscape is continuously changing. Having people, whose sole responsibility is to map-out that landscape for you, will assist your venture moving forward.

When working with us, we take all aspects of your business, including your budget. We offer packages, where you can get various digital marketing services for your business in Singapore that is worth your money. We can help you from creating SEO plans for running social media ads. We got you covered!

Hiring people to do digital marketing keeps you from the trial and error stage and gives you time to take better care of the other aspects of your business. We do it right because digital marketing is our business, and our business involves growing yours to new heights. Seven Wolves will help you thrive in digital marketing’s ever-changing landscape, and to do it better than anyone else.

Interested? Collaborate with Seven Wolves to put your digital marketing game to another level and introduce you to a world of possibilities. Contact us today.